Shopify Payments Review: Everything You Need To Know

If you own an online store on Shopify, one of the most critical things to do before you start selling is to set up a payment system. And Shopify Payments is still the most well-known name among the several payment providers that Shopify accepts. Therefore, Arrowtheme will give you Everything you need to know about Shopify Payments Review. Thus now let’s go.

What Are Shopify Payments?

ShopifyPaymentss is Shopify’s in-house payment provider that serves as your Shopify store’s default integrated payment gateway. It will manage everything until the money is in your bank account from your consumers entering their credit card information.

Shopify Payments is a product of Stripe technology. Therefore, they’re the same payment processor. However, Shopify payment processing is a merchant-friendly platform than Stripe. Moreover, it is completely integrated into your store dashboard. As a result, it becomes a very simple solution for ecommerce businesses.

Because you don’t need to go through a third-party source and get approval for a merchant account. And finally, your money is synced up with your sales and inventory when you finish setting up Shopify Payments for your store. So now let’s see the Shopify payments review as follows.

Related: 10+ Best Shopify Payment Providers You Should Know

Shopify Payments Fees

There are different kinds of fees associated with accepting payments in Shopify.

Credit Card Processing Fee

The fee charged by your payment provider for completing the entire transaction, including data transmission between buyers, sellers, issuing bank, and acquiring bank. In addition, this rate is determined by the service provider you select.

Transactions Fee

The fee that Shopify charges you for each transaction. Fortunately, when Shopify Payments is active, you will not have to pay any fee for this. Even if you offer a variety of payment options (including Shopify Payments) and your consumers choose PayPal at checkout, it is still free.

You have to pay a credit card processing fee based on your current Shopify plan, the number of purchases, and the total order amount.

Should eCommerce Businesses Use Shopify Payments?

| Pros | Cons |

| Setup and approval quickly. You don’t need to handle payments through a third-party provider. Because with Shopify payments, your finances will be in sync with your sales and inventory | Not accessible in every country. Although everyone in the world can open the Shopify store. However, Shopify Payments only supports a small number of countries. Moreover, in case you want to use Shopify payment in other countries that is not on the list of countries Shopify Payment support, Shopify must ensure that the Shopify version available there meets the country’s standards. |

| Complete integration. Because an integrated payment back office is also available in the dashboard for sellers. Therefore, all payments will be synchronized with the orders they correspond to. Thus, thanks to the Shopify payment, you are able to follow all orders with ease. | Non-exclusive. You can select as many supported providers as you like. With more payment options you’ll be able to take payments from your customers in a variety of ways. |

| There are no additional transaction fees. When you use third-party payment processors, you will be charged a transaction fee. The cost varies depending on the Shopify plan you select. If you’re using Advanced Shopify, Standard Shopify, or Basic Shopify, you’ll have to deduct 0.5%, 1%, and 2% of your revenue, respectively. Moreover, this figure might be in the hundreds of thousands of dollars every month, much above the Shopify subscription rate. | Funds can be frozen at any time. Shopify Payments will always freeze your payment until the matter is resolved if there is a chargeback or suspicious account activity that needs to be investigated. |

| Suitable for offline sales. Shopify POS and Shopify Payments are completely integrated. All of your business information is centralized, including online and in-store sales. | |

| Non-exclusive. You can select as many supported providers as you like. More payment options mean you’ll be able to take payments from your customers in a variety of ways. |

How To Set Up Shopify Payment Processing?

Before your customers can use their credit cards to purchase goods on your e-store, you must first set up and activate Shopify Payments. You can enable Shopify Payments in the Payment Providers area of the Shopify settings.

Step 1: Choose A Currency For Your Store

Please note that you have to select the correct currency. So you have to go to Settings > General > Store currency if you want to change your monetary unit.

Step 2: In Your Store’s Settings, Go To The Payments Area

You’ll find a section “Payments”: Enable and manage your store’s payment providers” after clicking on the Settings section on the left.

Step 3: Select Shopify Payments as your payment processor

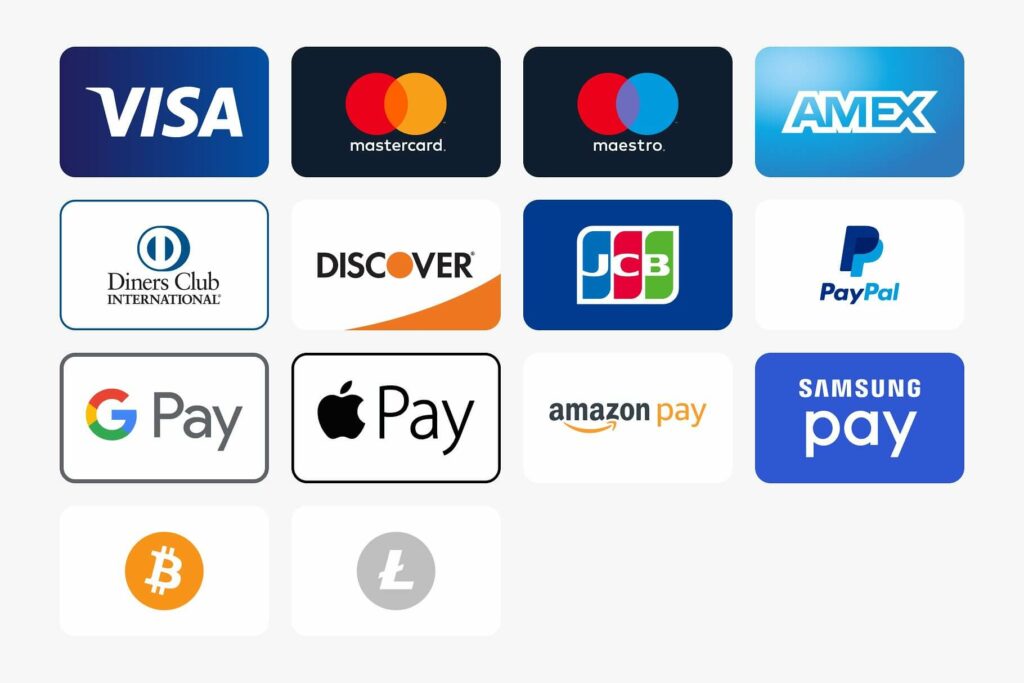

Shopify Payments is directly at the top of the payment provider list in the Accept credit cards section. Furthermore, Shopify has included some essential information such as credit card rates, transaction fees, and accepted payment methods. Moreover, when retailers compare it to other payment providers such as PayPal and Amazon Pay, they will notice that it is cheaper.

Simply click on “Complete account setup” and then provide Shopify with all of the relevant information.

Step 4: Setup Your Account Completely

In this step, you’ll find all of the information you need to set up your Shopify Payments account here. It includes business information, personal information, product information, customer billing statements, and banking information. Remember that before selecting the “Complete account setup” button at the bottom of the page, read the Shopify Payments terms and conditions.

Finally, you’ve completed the setup procedure. So now all you have to do is wait for Shopify. Because Shopify will examine your application and begin the approval process for local payment methods and credit card methods that are applicable.

Conclusion

Integrated payments provide a lot of advantages, and if your online store follows all of the regulations, Shopify Payments could be the best option for you. In case you want to read further about Shopify information. Hence, visit ArrowTheme blogs which have lots of interesting information waiting for you.

Contact US – ArrowTheme:

– Email: [email protected]

– Facebook: Facebook.com/ArrowThemeTeam

– Website: ArrowTheme.com